Posted on 16th October 2014

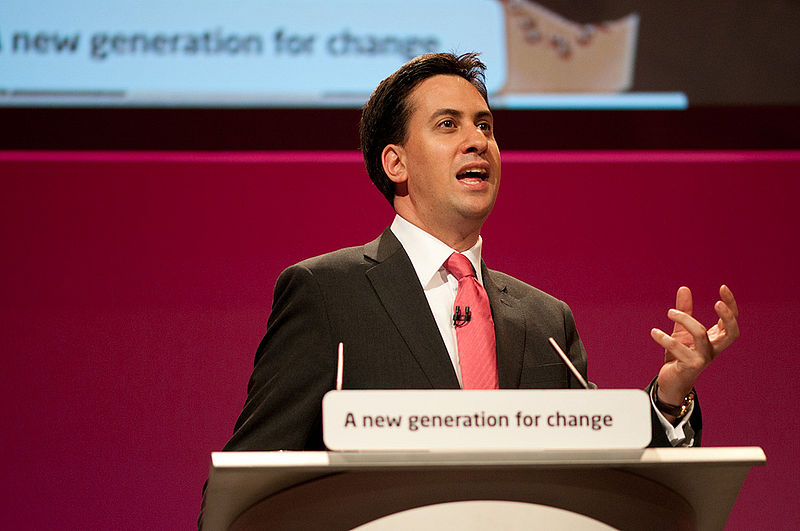

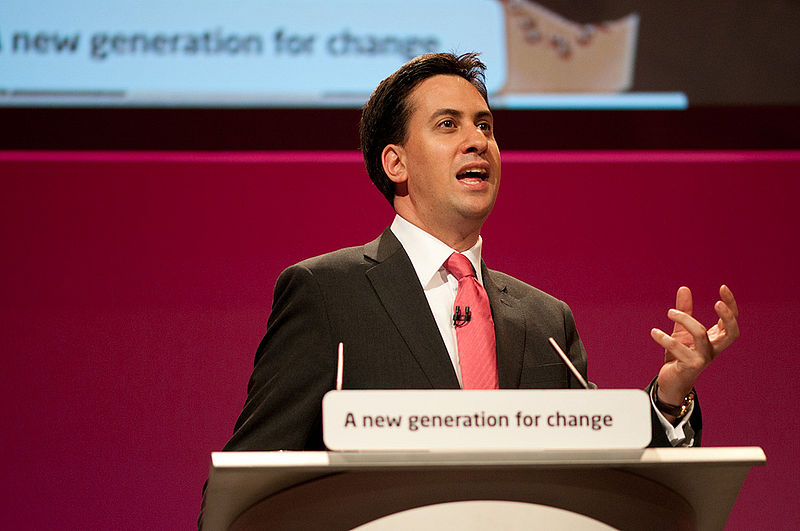

Over the past few weeks some of the biggest political parties in the UK have been hosting their last conferences before next year’s General Election. As expected, the leaders of each of these parties took the opportunity to announce a number of new policies which will affect both those living in the UK and investors. However, for Labour party leader Ed Miliband his speech will be remembered more for the fact that he did not […]

Over the past few weeks some of the biggest political parties in the UK have been hosting their last conferences before next year’s General Election. As expected, the leaders of each of these parties took the opportunity to announce a number of new policies which will affect both those living in the UK and investors. However, for Labour party leader Ed Miliband his speech will be remembered more for the fact that he did not […]

Posted on 3rd October 2014

Since the housing market crashed in 2008 the Bank of England has worked closely with the UK government in order to improve house prices and increase activity in the market. Now, the recession is finally over and throughout the year house prices have been increasing at a rapid rate, showing a growing amount of demand in the market.

Since the housing market crashed in 2008 the Bank of England has worked closely with the UK government in order to improve house prices and increase activity in the market. Now, the recession is finally over and throughout the year house prices have been increasing at a rapid rate, showing a growing amount of demand in the market.

Posted on 19th September 2014

Previously we wrote about what the vote for Scottish independence meant to the property market and now a decision has been reached we have a better insight into what the future holds.

The entire country was holding their breath last night to find out if Scotland would become an independent country. Since the result was revealed as No to Independence in theory nothing should change, however for many there will be a psychological change and not just in […]

Posted on 5th September 2014

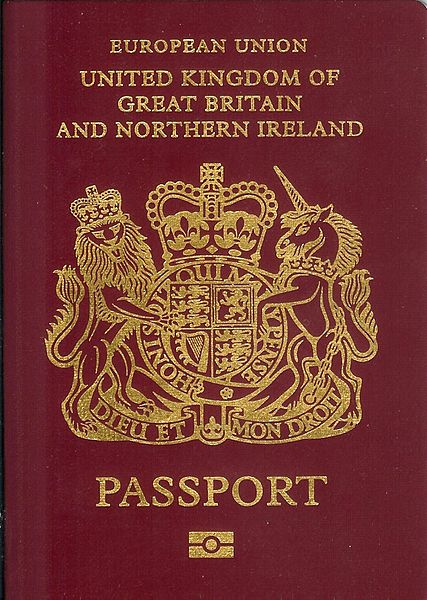

Due to current political tensions and the fact that the UK is still recovering from the recession the subject of illegal immigrants entering the UK is extremely controversial. Many people have called on the government to do more to prevent people entering the UK illegally, however this is no mean feat. This is why last year the government made law the Immigration Act which means that landlords may be asked to vet their tenants in […]

Due to current political tensions and the fact that the UK is still recovering from the recession the subject of illegal immigrants entering the UK is extremely controversial. Many people have called on the government to do more to prevent people entering the UK illegally, however this is no mean feat. This is why last year the government made law the Immigration Act which means that landlords may be asked to vet their tenants in […]

Posted on 22nd August 2014

You would be forgiven for thinking that the UK’s housing crisis is on its way out, especially with daily news reports claiming that the amount of prospective buyers looking to purchase properties is outstripping current supplies. However, the truth is that we still have a long way to go when it comes to fixing the issues in the UK’s housing market, a fact that has been highlighted by recent reports concerning social housing issues across […]

You would be forgiven for thinking that the UK’s housing crisis is on its way out, especially with daily news reports claiming that the amount of prospective buyers looking to purchase properties is outstripping current supplies. However, the truth is that we still have a long way to go when it comes to fixing the issues in the UK’s housing market, a fact that has been highlighted by recent reports concerning social housing issues across […]

Posted on 8th August 2014

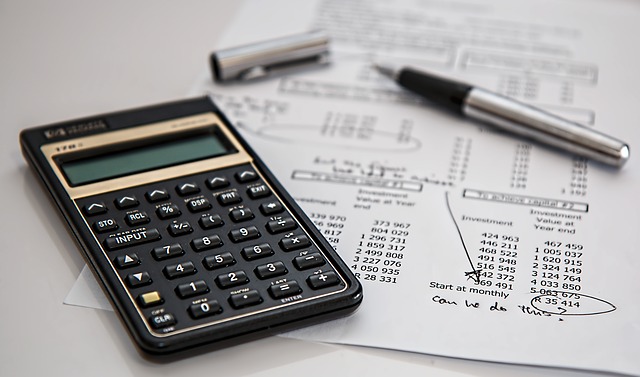

A few months ago PropertyQuoteDirect published a blog discussing how landlords can stay on the right side of the HMRC after the organisation announced that they would be cracking down on landlords who failed to pay their taxes. The organisation suggested that millions of pounds worth of tax is missing from the private rental sector, and much of this is down to the fact that inexperienced landlords are not filling in their […]

A few months ago PropertyQuoteDirect published a blog discussing how landlords can stay on the right side of the HMRC after the organisation announced that they would be cracking down on landlords who failed to pay their taxes. The organisation suggested that millions of pounds worth of tax is missing from the private rental sector, and much of this is down to the fact that inexperienced landlords are not filling in their […]

In order to stay ahead of the game landlords need to keep a keen eye on the property market as it enables them to buy and sell properties at opportune times. For instance, a number of landlords started expanding their property portfolios a few years ago when demand began to increase, and now most of these landlords are making a considerable amount of income each and every month. However, it’s not easy knowing where and when to buy property in the UK, especially as the […]

Just a few weeks ago PropertyQuoteDirect reported on the Bank of England’s new criteria for personal mortgages. At the time, those that work in the private rental sector were unsure of whether the Bank would also bring in harsher regulations for buy-to-let mortgages, and recently they have admitted that they have been considering it. However, even though the Bank of England have stated that they are looking into changing lending criteria for buy to let mortgages, they have no official plans as of […]

As house prices have continued to rise the Bank of England have been put under pressure to increase their interest rates in order to avoid another housing bubble. However, the Bank claimed that they were wary of doing this as a large percentage of the UK population are still struggling with the cost of living which means that if interest rates were increased households could start defaulting on their mortgage repayments. This is why the Bank of England’s Financial Policy Committee (FPC) met […]

There have been concerns recently that the property market is unstable and that even though the UK is currently recovering from the recession if the government doesn’t do something soon we may see another market crash. To make matters worse, not all parts of the UK are seeing the same rise in property prices as others, meaning that it is becoming difficult to afford properties in London and the south east while markets in other areas of the country are still struggling.

However, we are […]

Over the past few weeks some of the biggest political parties in the UK have been hosting their last conferences before next year’s General Election. As expected, the leaders of each of these parties took the opportunity to announce a number of new policies which will affect both those living in the UK and investors. However, for Labour party leader Ed Miliband his speech will be remembered more for the fact that he did not […]

Over the past few weeks some of the biggest political parties in the UK have been hosting their last conferences before next year’s General Election. As expected, the leaders of each of these parties took the opportunity to announce a number of new policies which will affect both those living in the UK and investors. However, for Labour party leader Ed Miliband his speech will be remembered more for the fact that he did not […]

Since the housing market crashed in 2008 the Bank of England has worked closely with the UK government in order to improve house prices and increase activity in the market. Now, the recession is finally over and throughout the year house prices have been increasing at a rapid rate, showing a growing amount of demand in the market.

Since the housing market crashed in 2008 the Bank of England has worked closely with the UK government in order to improve house prices and increase activity in the market. Now, the recession is finally over and throughout the year house prices have been increasing at a rapid rate, showing a growing amount of demand in the market.

Due to current political tensions and the fact that the UK is still recovering from the recession the subject of illegal immigrants entering the UK is extremely controversial. Many people have called on the government to do more to prevent people entering the UK illegally, however this is no mean feat. This is why last year the government made law the Immigration Act which means that landlords may be asked to vet their tenants in […]

Due to current political tensions and the fact that the UK is still recovering from the recession the subject of illegal immigrants entering the UK is extremely controversial. Many people have called on the government to do more to prevent people entering the UK illegally, however this is no mean feat. This is why last year the government made law the Immigration Act which means that landlords may be asked to vet their tenants in […] You would be forgiven for thinking that the UK’s housing crisis is on its way out, especially with daily news reports claiming that the amount of prospective buyers looking to purchase properties is outstripping current supplies. However, the truth is that we still have a long way to go when it comes to fixing the issues in the UK’s housing market, a fact that has been highlighted by recent reports concerning social housing issues across […]

You would be forgiven for thinking that the UK’s housing crisis is on its way out, especially with daily news reports claiming that the amount of prospective buyers looking to purchase properties is outstripping current supplies. However, the truth is that we still have a long way to go when it comes to fixing the issues in the UK’s housing market, a fact that has been highlighted by recent reports concerning social housing issues across […] A few months ago PropertyQuoteDirect published a blog discussing how landlords can stay on the right side of the HMRC after the organisation announced that they would be cracking down on landlords who failed to pay their taxes. The organisation suggested that millions of pounds worth of tax is missing from the private rental sector, and much of this is down to the fact that inexperienced landlords are not filling in their […]

A few months ago PropertyQuoteDirect published a blog discussing how landlords can stay on the right side of the HMRC after the organisation announced that they would be cracking down on landlords who failed to pay their taxes. The organisation suggested that millions of pounds worth of tax is missing from the private rental sector, and much of this is down to the fact that inexperienced landlords are not filling in their […]